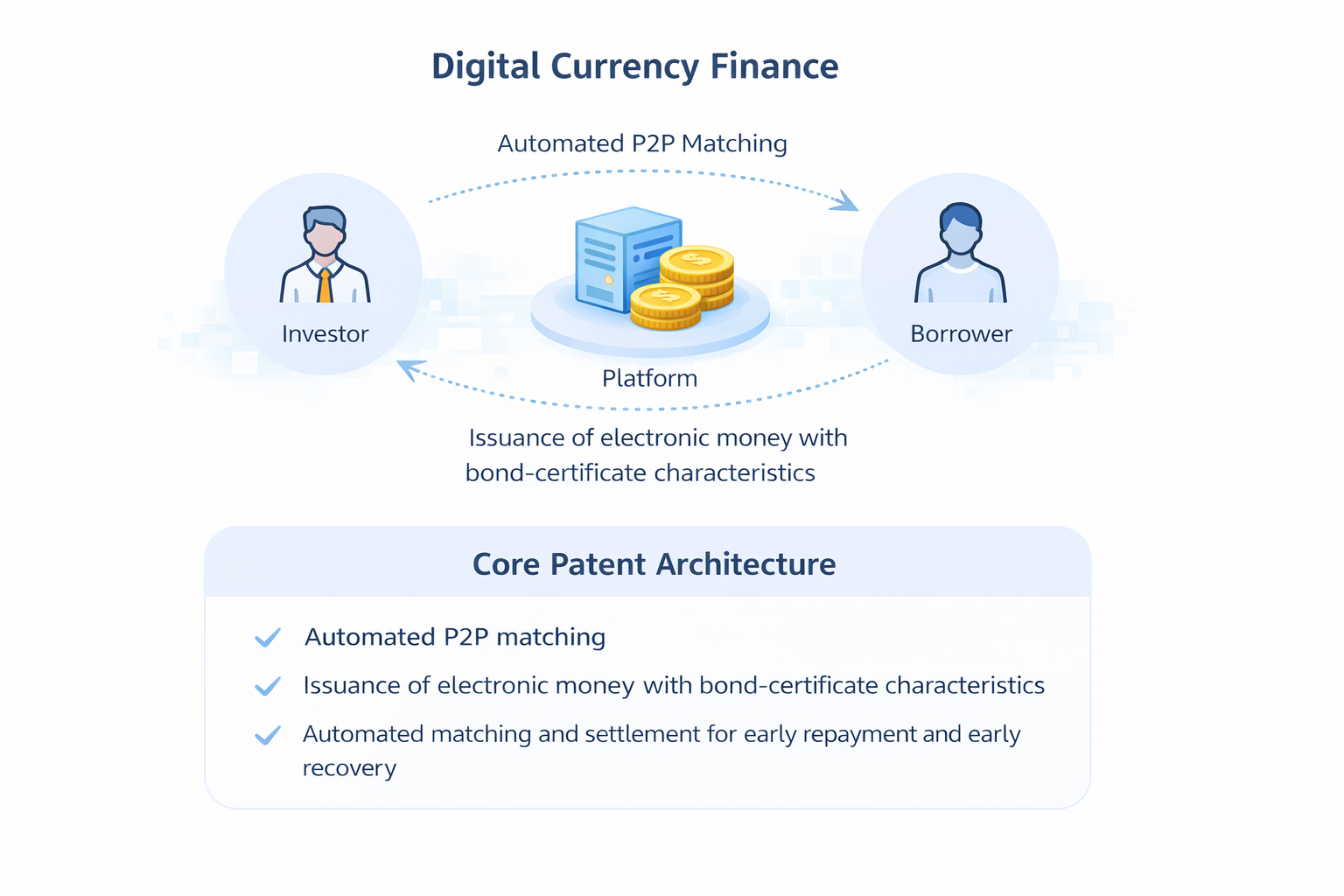

🌐 Digital currency finance

This patent issues digital currency (bonds) corresponding to investment funds, lends the funds to borrowers, and allows for early recovery or early repayment.

🌐Digital currency finance

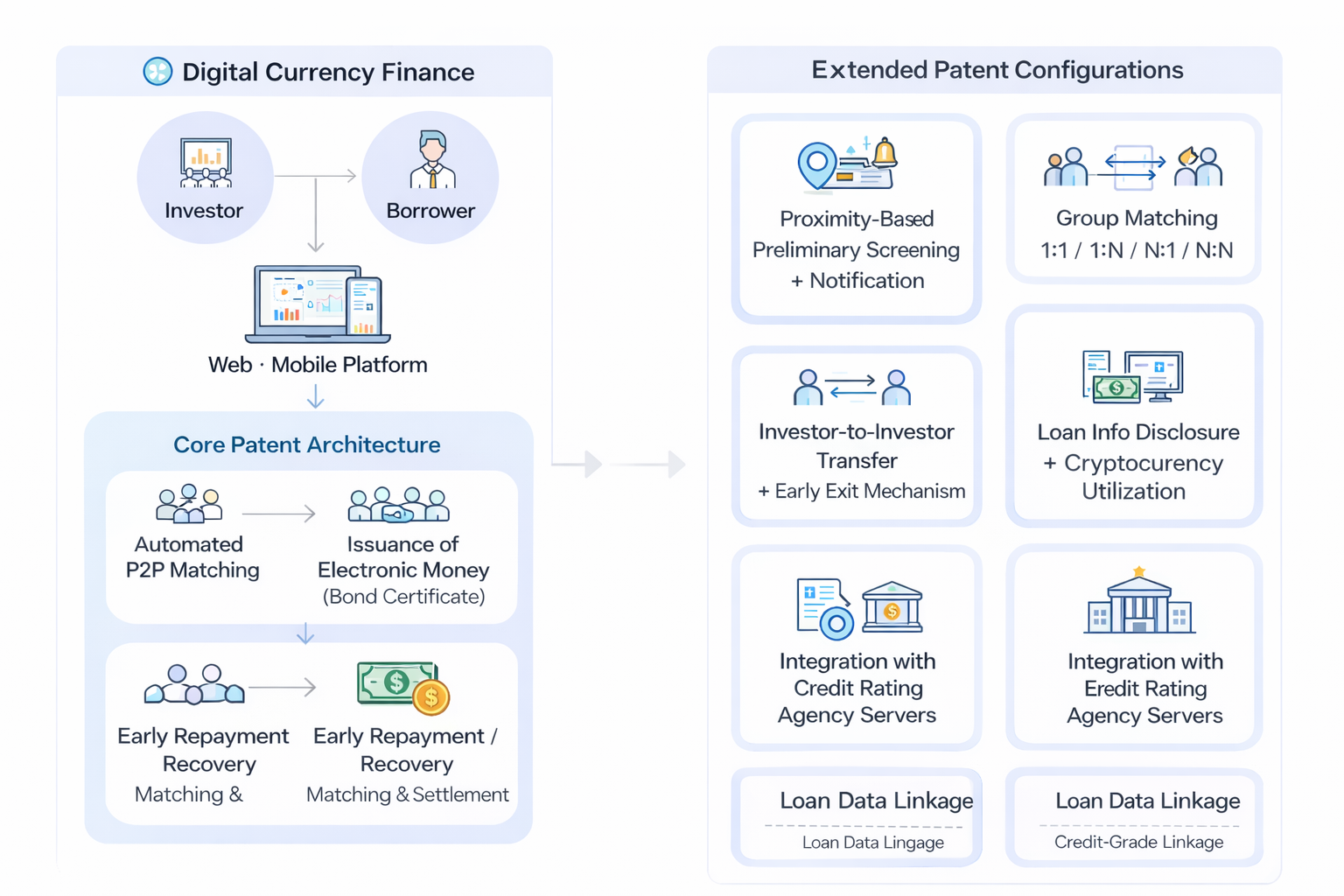

Core Patent Architecture

• Automated P2P matching

• Issuance of electronic money with bond-certificate characteristics

• Automated matching and settlement for early repayment and early recovery

Extended Patent Configurations

• Group matching: 1:1, 1:N, N:1, N:N

• Proximity-based preliminary screening with notification

• Investor-to-investor bond transfer and early-exit mechanisms

• Loan information disclosure and cryptocurrency usage

• Integration with credit rating agency servers

• Integration with financial institution servers

• Financial-institution-only integration (existing loan linkage)

• Credit-rating-only integration (credit-grade linkage)

🌐 System Overview

Digital Currency Finance is a technology that, within a P2P investment and lending structure where investor funds are provided to borrowers, enables the platform to issue electronic currency functioning as bond certificates and to automatically handle matching and settlement, including early repayment and early recovery situations.

In this patent, electronic money functions as a bond certificate, enabling flexible issuance of various forms of digital currency.

This platform is designed as a business-model (BM) patent, allowing a single core system to support multiple financial products and service configurations.

The extended configurations described above are not fixed requirements, but optional and independently deployable implementation modules that can be selectively combined or expanded depending on business needs, regulatory environments, or partnership structures.

Through this modular architecture, licensees can legally protect their core business model while flexibly scaling advanced digital finance services.