Patent Agreement Aimed at Global Standardization

Transparent finance / Safe finance / Decentralized finance / Accessible finance for all

Our patents are essential for your citizens.

Explore the power of our patent program.

Apply our patents to your platform.

About

GBFC & IP Team

GBFC IP Team refers to the intellectual property division of the Global Blockchain Finance Committee

56th Session of the Commission on Social Development, United Nations Headquarters

The GBFC IP team will collaborate with UN-registered NGOs and domestic platform companies to promote "transparent finance, safe finance, decentralized finance, and accessible finance for all" and contribute to solving issues such as hunger, wealth inequality, and urban network development.

- GBFC was launched in May 2019 at the United Nations Headquarters in Geneva, Switzerland, after 219 delegates, including mayors from 110 cities, NGO representatives, and experts from various fields, were officially accepted to a conference hosted by a non-governmental organization titled "Implementing Blockchain Finance for Poverty Eradication and Metropolitan Policies." Among them, 20 VIP members supported and passed a resolution on the human rights to life and a blockchain finance project aimed at a common currency.

- - This committee has issued several joint statements with international organizations, including the representative joint statement (https://docs.un.org/en/E/CN.5/2025/NGO/38) in 2025 and the joint statement (https://docs.un.org/en/A/HRC/45/NGO/3) in 2020.

- - The committee has also held several meetings with international organizations, the most notable of which is the 3rd Preparatory Committee Meeting for FfD4 in 2025. Project models are continuously being presented.

- The GBFC IP Team will work with these organizations to "develop a global support platform and support sector-specific blockchain systems," as stated by the GBFC. We aim to develop and support a platform model that reflects our purpose as a global standard.

If you identify any company utilizing the patents introduced on this website without proper licensing, we would appreciate it if you could notify us, enabling us to take appropriate steps regarding compensation.

ip services

Licensing Program

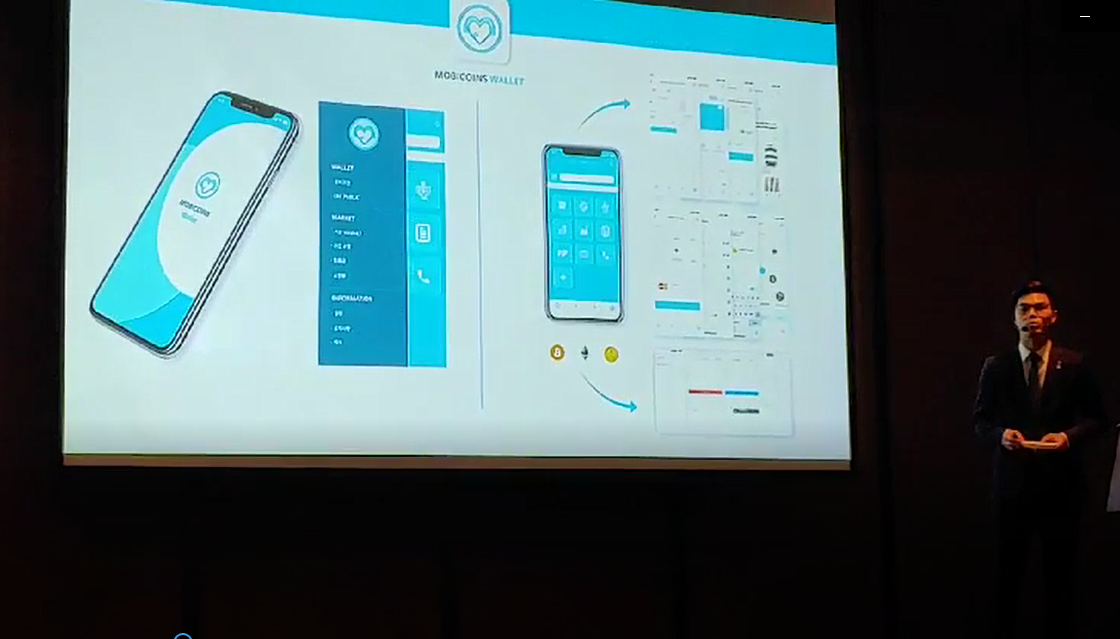

🌐 Digital currency finance

This patent issues digital currency (bonds) corresponding to investment funds, lends the funds to borrowers, and allows for early recovery or early repayment.

🔗 Blockchain finance

This patent provides an investment-lending platform that verifies and records digital bonds through blockchain validation, ensuring stability and transparency.

💳 Crypto-Linked Lending

This patent defines a loan-linked cryptocurrency payment rate and enables parallel transfers of cash, cryptocurrency, and point-based cryptocurrency using one or more blockchain networks.

📦 Asset-to-Crypto Exchange Finance

This patent provides a platform that issues cryptocurrency based on asset valuation at registration, confirms ownership transfer and delivery, and manages refund mechanisms.

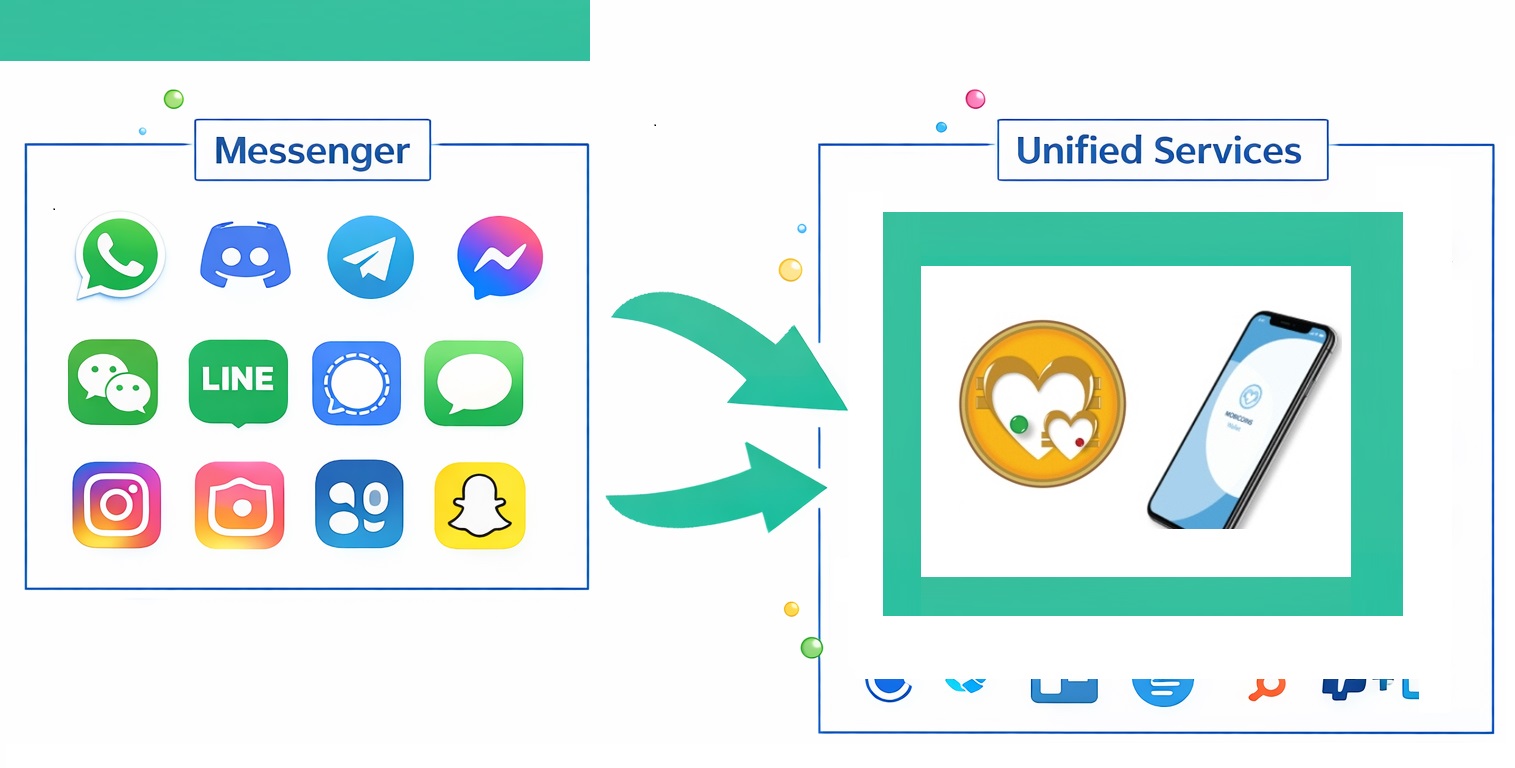

💬 Integrated Messenger

This patent provides a platform that integrates multiple messenger applications, displays unified conversation lists and message indicators, and manages lock settings automatically.

🚀 Drone Delivery (In Preparation)

This patent is pending determination of the most appropriate filing jurisdiction and filing date. For business inquiries, please contact us through secure channels.

Happy Clients

Hard Projects

Hours Of Support

Intellectual Property Licensing

agreement

Industries Requiring Patent Licenses

Public Digital Currency

Industry Overview

Public digital currency refers to government-issued or government-endorsed digital value units used for payments,

transfers, settlement, or conditional disbursement within public or semi-public systems. This category includes

CBDC pilot systems, regional or municipal digital currencies, and public payment infrastructures operated directly

or indirectly by state-affiliated entities. These systems emphasize traceability, programmability, and integration

with existing financial and administrative platforms.

-

Why Patent License Is Required

Public digital currency systems are structurally required to operate a platform-centric architecture that issues digital value representations, matches participants (issuers, holders, beneficiaries), and manages redemption, transfer, and early recovery or settlement conditions. - Your patent portfolio covers this unavoidable platform structure: automated matching between multiple parties, issuance of electronic value corresponding to funds or rights, and synchronized settlement across financial and ledger systems. From a system-design perspective, avoidance is difficult because public digital currency platforms must centralize issuance logic, transaction validation, and conditional settlement.

-

Applicable Licensing Programs

Digital Currency Finance

Blockchain Finance -

Typical Licensees

Central banks and monetary authorities;

national or regional government agencies operating digital currency pilots;

local governments issuing or managing regional or municipal digital currencies;

public financial infrastructure operators or government-affiliated platform providers.

Operating a public digital currency platform without a patent license exposes the operator to structural infringement risk, potential injunctions affecting system continuity, and downstream contractual or policy disruption. Unresolved IP risk may delay deployment, complicate inter-agency cooperation, and weaken legal certainty for participating financial institutions and technology partners.

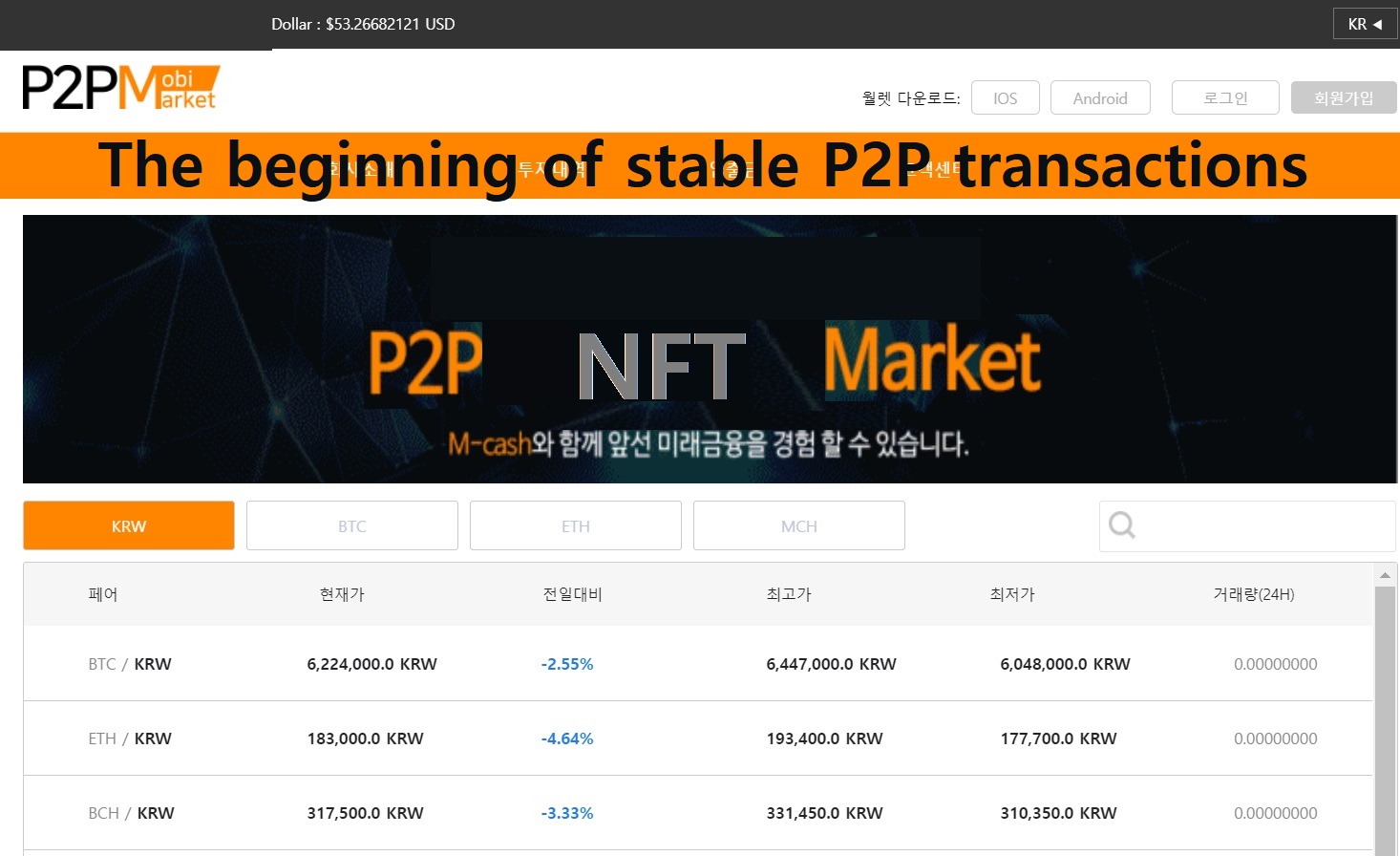

P2P Lending

Industry Overview

P2P lending refers to digital platforms that directly connect individual or institutional investors

with borrowers for the purpose of originating, funding, and managing loans. These platforms operate

as intermediaries that facilitate loan matching, disbursement, repayment, and settlement while

integrating compliance, risk management, and reporting functions within regulated financial environments.

-

Why Patent License Is Required

P2P lending platforms are structurally required to implement a platform-centric matching architecture that connects multiple investors and borrowers, allocates funds, and manages loan origination, repayment, and conditional settlement processes. - Your patent portfolio covers this unavoidable structure, including automated multi-party matching, issuance and management of electronic representations corresponding to loan or investment rights, and synchronized settlement across platform servers and financial institution systems. From a system-design perspective, avoidance is difficult because core P2P lending functions must be centrally coordinated to ensure regulatory compliance and transactional integrity.

-

Applicable Licensing Programs

Digital Currency Finance

Blockchain Finance

Crypto-Linked Lending -

Typical Licensees

P2P lending platform operators and fintech lending companies;

financial institutions offering P2P-based or platform-mediated lending products;

asset managers or investment firms participating in marketplace lending;

technology providers operating loan-matching or lending infrastructure for regulated entities.

Operating a public digital currency platform without a patent license exposes the operator to structural infringement risk, potential injunctions affecting system continuity, and downstream contractual or policy disruption. Unresolved IP risk may delay deployment, complicate inter-agency cooperation, and weaken legal certainty for participating financial institutions and technology partners.

NFT Markets

Industry Overview

NFT markets refer to digital platforms that issue, list, trade, and manage non-fungible tokens

representing unique digital or real-world assets. These platforms operate as intermediaries

facilitating ownership registration, transaction matching, settlement, and secondary-market

transfers within blockchain-based or hybrid ledger environments.

-

Why Patent License Is Required

NFT marketplaces are structurally required to implement a platform-centric architecture that issues digital representations of assets, matches buyers and sellers, and manages ownership transfer, settlement, and transaction records across platform and ledger systems. - Your patent portfolio covers this unavoidable structure, including automated matching between participants, issuance and transfer of electronic representations corresponding to asset ownership or usage rights, and synchronized settlement across platform servers and blockchain or financial systems. Design-around is difficult because these functions must be centrally coordinated to ensure integrity, traceability, and market reliability.

-

Applicable Licensing Programs

Blockchain Finance

Asset-to-Crypto Exchange Finance -

Typical Licensees

NFT marketplace operators and digital asset trading platforms;

companies issuing NFTs linked to digital content, collectibles, or physical assets;

financial institutions or custodians supporting NFT-based asset services;

technology providers operating NFT issuance or marketplace infrastructure.

Operating an NFT marketplace without a patent license exposes the operator to structural infringement risk related to core issuance, matching, and settlement mechanisms. This may lead to legal disputes, service disruption, and reduced confidence among creators, users, and institutional partners, particularly in regulated or cross-border environments.

STO Platforms

Industry Overview

STO platforms refer to digital systems that issue, distribute, and manage tokenized securities or

investment products under applicable securities regulations. These platforms support investor onboarding,

offering subscriptions, allocations, and post-issuance lifecycle operations such as transfers, settlement,

and disclosures, often through integrations with financial institutions and custody or ledger infrastructures.

-

Why Patent License Is Required

STO platforms are structurally required to implement a platform-centric architecture that coordinates multi-party participation (issuers, investors, brokers/custodians), manages subscription and allocation, and executes transfer and settlement workflows in a controlled and auditable manner. - Your patent portfolio covers this unavoidable platform structure, including automated matching and allocation logic among multiple parties, issuance and management of electronic representations corresponding to investment rights, and synchronized settlement across platform servers and financial/ledger systems. Design-around is difficult because compliance-driven controls (KYC/AML, transfer restrictions, audit trails, and lifecycle management) require centralized orchestration.

-

Applicable Licensing Programs

Digital Currency Finance

Blockchain Finance

Asset Tokenization -

Typical Licensees

STO issuance and distribution platforms;

broker-dealers, securities firms, and regulated intermediaries operating tokenized offerings;

banks, custodians, or transfer agents supporting issuance, custody, or settlement;

technology providers operating compliant issuance/settlement infrastructure for regulated entities.

Operating an STO platform without a patent license exposes the operator to structural infringement risk related to core issuance, allocation, and settlement mechanisms. This may lead to legal disputes, potential injunction risk affecting offering continuity, and reduced legal certainty for issuers, investors, and regulated partners across compliance-sensitive workflows.

Asset Tokenization

Industry Overview

Asset tokenization refers to platforms that digitally represent ownership, usage, or economic

rights in real-world or intangible assets through electronic or tokenized units. These systems

support issuance, allocation, transfer, and settlement of asset-linked digital representations,

often integrating valuation, custody, and compliance functions across financial and ledger-based

infrastructures.

-

Why Patent License Is Required

Asset tokenization platforms are structurally required to implement a platform-centric architecture that converts asset value into digital representations, manages participant access, and coordinates issuance, transfer, and settlement under defined conditions. - Your patent portfolio covers this unavoidable structure, including automated multi-party matching, issuance and management of electronic representations corresponding to asset interests, and synchronized settlement across platform servers, custodians, and financial or distributed ledger systems. Design-around is difficult because valuation linkage, ownership tracking, and conditional transfer must be centrally orchestrated to preserve legal and economic consistency.

-

Applicable Licensing Programs

Asset-to-Crypto Exchange Finance

Blockchain Finance -

Typical Licensees

platforms tokenizing real estate, commodities, or physical infrastructure assets;

companies issuing fractionalized ownership or revenue-linked digital assets;

financial institutions, custodians, or trustees supporting tokenized asset services;

technology providers operating asset tokenization and settlement infrastructure.

Operating an asset tokenization platform without a patent license exposes the operator to structural infringement risk related to core issuance, allocation, and settlement mechanisms. This may result in legal disputes, constraints on asset distribution or transfer, and reduced confidence among asset owners, investors, and institutional partners in regulated or cross-border contexts.

Messenger Services

Industry Overview

Messenger services refer to digital platforms that enable real-time or asynchronous communication

between users through text, voice, multimedia, or data messages. Modern messenger platforms often

integrate identity management, content exchange, and service-layer extensions, operating as

foundational infrastructure for personal, commercial, and institutional communications.

-

Why Patent License Is Required

Messenger service platforms are structurally required to implement a centralized or semi-centralized platform architecture that manages user identities, session coordination, message routing, and synchronized data exchange across multiple endpoints. - Your patent portfolio covers this unavoidable structure, including automated matching and coordination between multiple users, issuance and management of electronic identifiers or message-related data objects, and synchronized processing across platform servers and communication networks. Design-around is difficult because reliability, latency control, and service integrity require centralized orchestration of messaging workflows.

-

Applicable Licensing Programs

Integrated Messenger

Blockchain Finance -

Typical Licensees

operators of consumer or enterprise messenger applications;

platform providers integrating messaging with payments, identity, or service modules;

telecommunications or internet companies offering messaging-based services;

technology providers operating messaging infrastructure for third-party platforms.

Operating a messenger service platform without a patent license exposes the operator to structural infringement risk related to core user coordination, message routing, and synchronized data processing mechanisms. This may result in legal disputes, service disruption, and reduced trust among users and enterprise or institutional partners relying on the platform as a core communication infrastructure.

Chat & Super Apps

Industry Overview

Chat and super apps refer to platforms that combine messaging with multiple integrated services

such as payments, commerce, content, booking, identity, and third-party mini-app ecosystems.

These platforms operate as multi-service hubs that coordinate user access, transactions, and

service delivery through a unified account and interface.

-

Why Patent License Is Required

Chat and super apps are structurally required to implement a platform-centric architecture that coordinates multi-party interactions, manages unified identity and session control, and synchronizes messaging and transactional workflows across multiple internal modules and external service providers. - Your patent portfolio covers this unavoidable structure, including automated matching and coordination among users and service participants, issuance and management of electronic representations related to rights, balances, or service entitlements, and synchronized settlement or processing across platform servers and integrated financial or ledger systems. Design-around is difficult because super apps require centralized orchestration to maintain consistency across identity, messaging, payments, and third-party service execution.

-

Applicable Licensing Programs

Integrated Messenger

Digital Currency Finance

Blockchain Finance -

Typical Licensees

super app operators offering integrated messaging and multi-service ecosystems;

messenger platforms expanding into payments, commerce, or mini-app marketplaces;

fintech or payment providers embedded within chat-based user journeys;

technology providers operating identity, messaging, and platform integration infrastructure.

Operating a chat or super app platform without a patent license exposes the operator to structural infringement risk related to core multi-service orchestration, identity coordination, and synchronized processing across integrated modules. This may lead to legal disputes, disruption of embedded financial or service workflows, and reduced confidence among users and institutional partners relying on the platform ecosystem.

Crypto Lending

Industry Overview

Crypto lending refers to platforms that provide loans secured by crypto assets or that lend crypto

or fiat through digital accounts, often with automated collateral management and liquidation rules.

These platforms coordinate borrowers, lenders, and custodial or settlement systems to originate,

manage, and settle loan obligations across on-chain and off-chain environments.

-

Why Patent License Is Required

Crypto lending platforms are structurally required to implement a platform-centric architecture that matches lenders and borrowers, manages collateral locking or control, and synchronizes loan disbursement, repayment, and conditional settlement or liquidation processes across blockchain networks and financial systems. - Your patent portfolio covers this unavoidable structure, including automated multi-party matching, issuance and management of electronic representations corresponding to loan rights, balances, or rate-linked value units, and synchronized settlement across platform servers, blockchain networks, and (where applicable) financial institution systems. Design-around is difficult because collateral governance, transaction integrity, and risk controls require centralized orchestration of core lending workflows.

-

Applicable Licensing Programs

Crypto-Linked Lending

Blockchain Finance

Digital Currency Finance -

Typical Licensees

crypto exchanges and digital asset platforms offering lending or margin products;

centralized crypto lending companies and collateralized loan providers;

banks or financial institutions piloting crypto-backed lending or custody-linked credit;

technology providers operating collateral management, risk engines, or lending infrastructure.

Operating a crypto lending platform without a patent license exposes the operator to structural infringement risk related to core matching, collateral control, and synchronized settlement or liquidation mechanisms. This may lead to legal disputes, potential injunction risk affecting ongoing lending services, and reduced certainty for users and institutional partners in compliance-sensitive or cross-border operations.

Frequently Asked Questions

FAQ

❓ 1. We were operating our business without being aware that the patent had been registered.

If your service falls within the scope of protection of this patent, you are required to pay fees for past use in accordance with applicable laws.

The scope of retroactive application varies by country based on patent laws and specific factual circumstances.

Companies that enter into a license agreement at an early stage will be subject to review of reasonable and preferential conditions during the negotiation process.

❓ 2. We have been operating our business since before the patent was registered.

Your company may be entitled to a prior user right under the patent laws of the relevant country.

However, if a license agreement is executed, we provide an official indication confirming lawful patent use.

This helps prevent misunderstandings with third parties or regulatory authorities.

❓ 3. We would like to start our business in a country where the patent has not yet been registered.

This patent is designed for global business expansion.

Based on your business plan, we will promptly proceed with patent filing in the relevant country.

We also support expansion into other countries where the patent is already registered.

❓ 4. With whom and how is the license agreement concluded?

The license agreement is concluded through this website as a tripartite agreement among the patent holder, our company, and your company.

The agreement must be executed by the entity operating the platform or service.

The license may not be transferred to or used by any third party.

❓ 5. We would like to conduct business using your platform.

This is possible.

The technology is designed for global standardization and supports customization based on local regulations and business environments.

Platform provision or technology transfer will be announced once ready.

❓ 6. We hold our own patents, and they appear unrelated.

Patent relationships must be assessed by comparing claim scope, filing and registration dates, and technical structures.

Depending on circumstances, disputes may arise, or cooperation may lead to standardization or joint business.

❓ 7. How is the license fee calculated?

License fees are calculated based on the technical contribution of the patent and the actual revenue structure.

Agreements may include an annual fixed base license fee and a revenue-linked royalty structure.

❓ 8. Is there a way to participate as an investor?

If you wish to participate, please submit a letter of investment intent.

After review, individual guidance will be provided, typically within seven days.

Investment structures may vary by patent field and business stage.

※ For all other inquiries, please contact us via email at any time. Thank you.

Team

CHECK OUR TEAM